Want To Make $10,000 In 10 Days?

Feeling stuck in your sales goals? What if you could make $10,000 in just 10 days? With my easy-to-follow sales tactics, it's not just possible, it's doable!

And I'm giving it away for free...

How to prospect, and sell $10k of your product in 10 days using my special outbound and inbound sales tactics.

FOUNDER FEATURED IN:

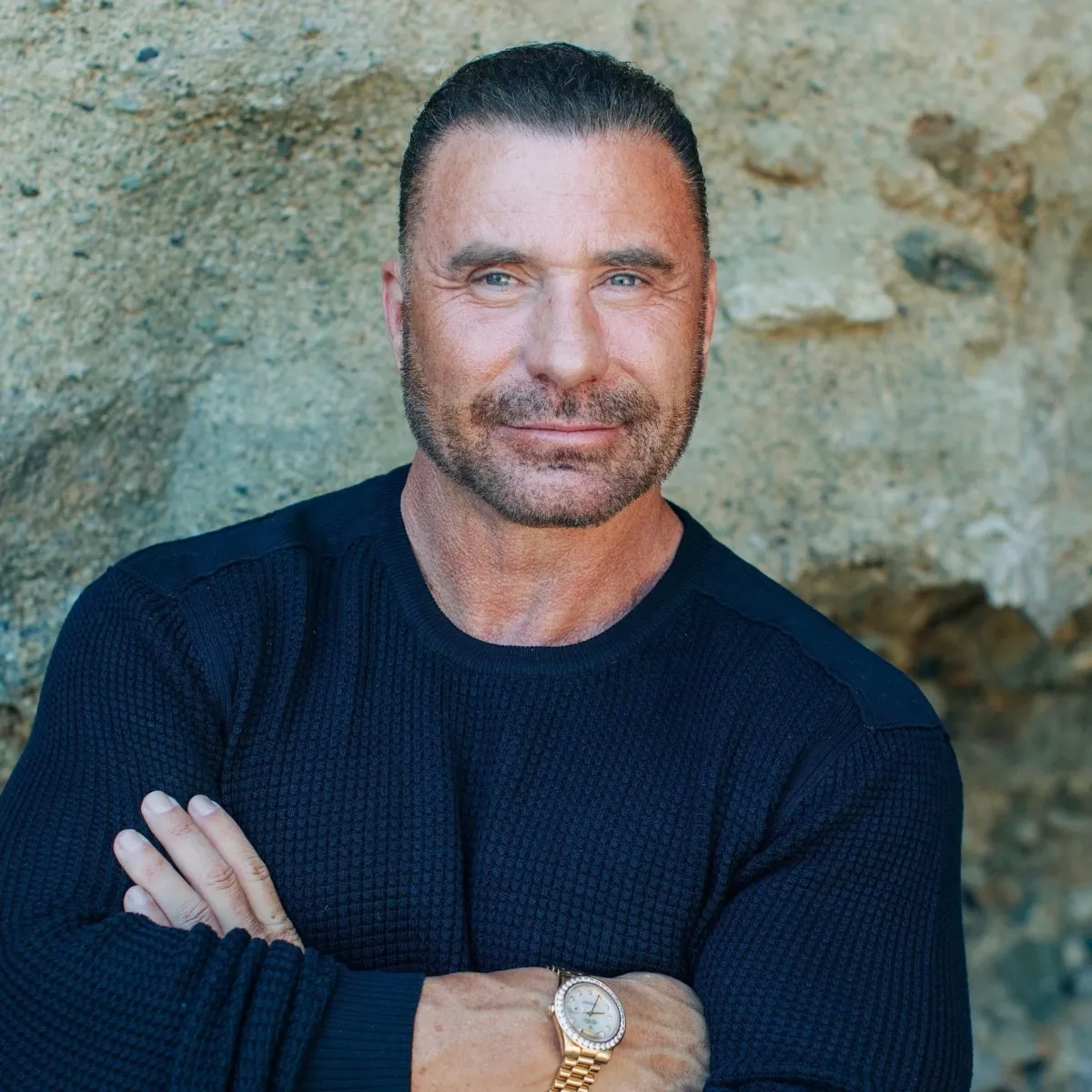

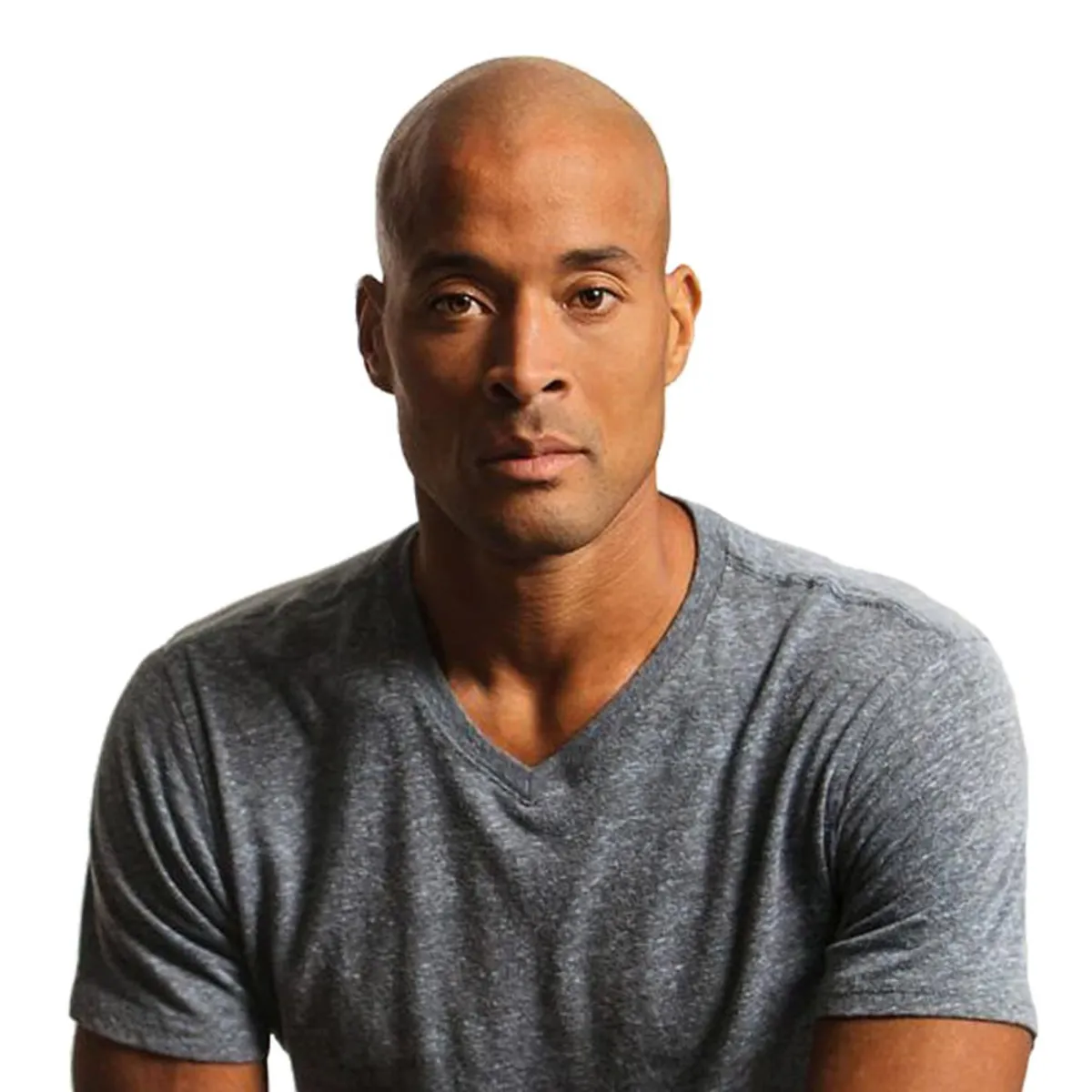

ABOUT RYAN STEWMAN

BEST SELLING AUTHOR

Ryan Stewman's financial journey began in 2004, a path that has seen him navigate and successfully close thousands of financial transactions, culminating in an impressive total exceeding $250 million over his distinguished 19-year career.

In the intricate world of debt, Ryan Stewman possesses a unique mastery—understanding its inner workings and leveraging that knowledge for profitability. His expertise has been a guiding force for thousands of clients seeking financing for a diverse array of projects and investments.

For a decade, Ryan has shared his life with his wife, Amy Stewman, and their four children. Their home is firmly rooted in the Dallas, Texas metroplex, a city that has been Ryan's anchor for over 44 years.

Beyond his role in finance, Ryan stands as the founder of several corporations, each boasting eight-figure revenues and spanning various industries from real estate to software. Currently, Ryan is deeply involved in 63 companies, actively overseeing the operations of five on a daily basis.

In addition to his financial prowess, Ryan has curated an impressive portfolio. His ownership and sales include over $5 million worth of Rolexes, $4 million in exotic cars, and a real estate portfolio valued at a staggering $150 million.

This trailblazer in his field has left an indelible mark, with over 81,000 individuals having chosen to invest in his products and services since 2018.

In an industry often clouded by facades and hollow promises, Ryan remains a paragon of authenticity. His commitment to genuine success is unparalleled, making it a formidable task to find a peer with a comparable track record and level of expertise.

Rise Above 🇺🇸

WHAT INDUSTRY LEADERS HAVE TO SAY

Ed Mylett

"I've been around this industry for a long time and I'm telling you, straight up, Ryan Stewman is the real deal. This guy is who he says he is and you're fortunate to be a part of his network."

Patrick Bet David

“Ryan is one of the best writers on social media I have ever seen, when I asked him who wrote his posts I couldn’t believe he does them himself, he’s a very impressive and creative person”

David Goggins

"In 2017 Ryan told me what he was going to do. In 2022 I watched his vision come to life. At first, if Im being real, I didn't believe him, but I tell you that motherfucker does EXACTLY what he says he's going to do."

Frank Kern

"I've Never Seen Anyone Build Something As Big As Ryan Has Built Apex Without Running Paid Traffic. Stewman Literally Defies Everything I've Ever Taught Him About Running Ads. For The Love Of God Stewman Will You Just Run Some Damn Ads? At The Least Send A Damn Email Or 2."

Kent Clothier

"Stewman Is The Realest Dude I Know. If He Says Something, It's What He Says It Is. The Guy Knows His Stuff, Is A Great Leader & He's One Of The Best Writers Around."

CONNECT WITH ME